Content

- Why States Went After TurboTax

- Please complete the security check to access freetaxusa.com

- TurboTax’s prices

- Hospices in Four States to Receive Extra Scrutiny Over Concerns of Fraud, Waste and Abuse

- Choose from IRS Free File:

If you have questions about the software product when filing your return, you must contact their customer support area. The Michigan Department of Treasury does not offer technical assistance or customer support for the software products listed. Once you start working on your return, TurboTax will run you through a series of Q&A-style and fill-in-the-blank questions and import documents (e.g., W-2, 1099s) automatically where possible to eliminate time-consuming manual entry. Questions are phrased simply, and tax jargon is kept at a minimum. This makes the process of filing your taxes generally seamless — the program never drops the curtain between you and the IRS forms. You simply answer questions and your return gets filled in behind the scenes.

If you have a federal adjusted gross income of up to $100,000 (up to $150,000 if filing jointly) you are entitled to a $3,200 exemption on the Maryland return. See the Exemption Amount Chart included in Instruction 10 of the Maryland Resident tax booklet. You are required to file a return if your gross income exceeds the amount listed for your filing status. Taxpayers who donate to a qualified charitable entity may subtract up to $1,000 of donations to a qualified charitable entity from their federal adjusted gross income to determine their Maryland adjusted gross income. Eligible donations include (1) disposable diapers, (2) other hygiene products for infants and children, (3) feminine personal hygiene products, or (4) cash specifically designated for the purchase of these products.

Why States Went After TurboTax

Statutory resident – You maintain and occupy a place of abode (that is a place to live) for more than 6 months of the tax year in Maryland. Using links other than what’s provided below may result in fees or charges. Justin Elliott is a ProPublica reporter covering politics and government accountability. To securely send Justin documents or other files online, visit our SecureDrop page or reach him through one of the methods below. If you made less than $34,000, you were eligible to file for free with TurboTax.

- First, do some research to help you avoid the “upgrade” trap after you’ve entered all of your tax information.

- NerdWallet, the personal finance website, did a lot of the legwork for you.

- Please review the links at the bottom of the page, and choose the filing method that best fits your needs.

- You can also have a CPA or enrolled agent review your return before you file.

- Just answer simple questions, and we’ll guide you through filing your taxes with confidence.

- Even if you are not required to file a federal return, you may be required to file a Maryland return if your Maryland addition modifications added to your gross income exceed the filing requirement for your filing status.

To qualify for the credit, the licensed physician must have worked in an area of Maryland identified as having a health care workforce shortage by the Maryland Department of Health (MDH). The licensed physician must have worked a minimum of three rotations, each consisting of 160 hours of community-based clinical training. The individual who claimed the credit shall pay the total amount of the credit claimed as taxes payable to the State for the taxable year in which the event requiring recapture of the credit occurs.

Please complete the security check to access freetaxusa.com

Please include your name, address, Social Security number, the tax year you are requesting and your signature. If you are requesting a copy of a joint return, include the information for both taxpayers and their signatures. As the military spouse, you remain a nonresident for purposes of Maryland taxation, and are not required to file a Maryland return, unless you received non-military income from Maryland sources. You may choose to file a joint resident return using Form 502, or your civilian spouse may file a separate resident return.

- We’ve long praised TurboTax for its design and user experience.

- The following vendors were approved by DOR for individually prepared tax returns.

- • If you owed taxes in previous years but didn’t file tax returns, you can stop some penalties and interest by filing back taxes, even if you are unable to pay the balance you owe.

- If you are eligible for a refund, you may be able to have your tax prep fees deducted directly from that refund through our eCollect program.

- TaxAct provides most of the standard features, such as importing your W-2 and last year’s return.

You must file your extension request and include your payment for any estimated amount due by April 18. The extension just allows you to delay filing your full return until October 15, 2023. Yes, Cash App Taxes is 100% free for state and federal returns. Even if you‘re taking deductions or credits, it won‘t cost you a penny to file your taxes. If you are a retired member of the military, you may be able to subtract up to $5,000 of your military retirement income from your federal adjusted gross income before determining your Maryland tax.

TurboTax’s prices

The provider’s answers, combined with our specialists’ hands-on research, make up our proprietary assessment process that scores each provider’s performance. With its intuitive design and variety of human support options, https://turbo-tax.org/ TurboTax is in many ways the standard for the do-it-yourself tax-prep industry. Its products come at a price, however, and confident filers might find that similar offerings from competitors may provide a better value.

- Here, you’ll find all the tax software filing support you need to file with ease.

- If you are a legal resident of Maryland and serving in the military, you must file a resident Maryland tax return, regardless of where you are stationed.

- Unless you already know you’re going to need to work with a CPA, or you have student loan debt or college tuition payments and want to file for free, you should start with TurboTax Free Edition.

Besides having an outdated interface, FileYourTaxes.com charges $45 to file a printed federal return, even if you have a simple return. Most importantly, when you hire a tax pro, you establish a relationship with one person you can count on every year. A tax pro who knows you can provide personalized advice and help you save money in future tax years. Should you have any problems with the IRS, your CPA or EA will be available to help (sometimes for an additional fee, and sometimes as part of their normal responsibilities).

Hospices in Four States to Receive Extra Scrutiny Over Concerns of Fraud, Waste and Abuse

Here’s what you need to make filing your own taxes even easier. Georgia Individual Income Tax returns must be received or postmarked by the April 18, 2023 due date. https://turbo-tax.org/turbotax-2019-tax-software-for-filing-past-years/ That all depends on your budget, how much you’re willing to pay for peace of mind, and if there’s anything in your return that’s likely to flag an audit.

Why is TurboTax not showing last years return?

The most common reason for not finding returns is signing in with the wrong user ID, which can happen if you have multiple accounts. It's best to use the same account every year so all of your tax returns will be stored in one place.

Content

- What’s the Difference Between a Bookkeeper and an Accountant?

- What are Bookkeeping Duties? – The Jobs, Skills, Salary & Career Paths of Bookkeepers

- Do Bookkeepers Need a Degree?

- How Much Money Can Bookkeeping Businesses Really Make?

- Continued Education

- Dallas Based BPO, Rocket Station, Recognized Amongst Industry Giants

A bookkeeper is skilled at keeping documents and tracks a wide net of financial information. However, bookkeeping and accounting clerk jobs are expected to decline, with the BLS projecting a 5% fall in jobs over the same period. The BLS notes that job growth for accountants should track fairly closely with the broader economy. However, bookkeepers will face pressure from automation and technology that will reduce the demand for such workers.

Small business owners depend on bookkeepers to keep their finances in order and ensure that their taxes are correct and current. Bookkeepers can help with everything from budgeting to payroll, saving business owners time and money. Using technology to enter data and do other tasks is an important skill for people who want to become bookkeepers. For any bookkeeping job, you need to know how to use software like Microsoft Excel, and candidates must have experience with spreadsheets and other software. Accounting is based on keeping accurate and complete records, so bookkeeping is the foundation of accounting. Because they are the source of most of the accounting information in the system, bookkeepers often have to make decisions based on analysis and use their own judgment when they record business events.

What’s the Difference Between a Bookkeeper and an Accountant?

All entries must be correct and complete before they can be sent up the management chain for approval or further processing into reports or other documents used by decision-makers in an organization. If you are in a position where you need to be reliable, you should be able to say that you will accept responsibility for a project and finish it within the allotted amount of time. When you pay close attention to the details, you make sure that your calculations and totals are correct and that you and your coworkers will have fewer problems and headaches in the future.

It is not enough to have the knowledge and skills necessary to be an excellent bookkeeper; there is much more to learn. You should be interested in learning more about the position and furthering your law firm bookkeeping education whenever the opportunity presents itself to keep up with the many changes and updates in this line of work. Touch typing is a distinct advantage that will save you time in the long run.

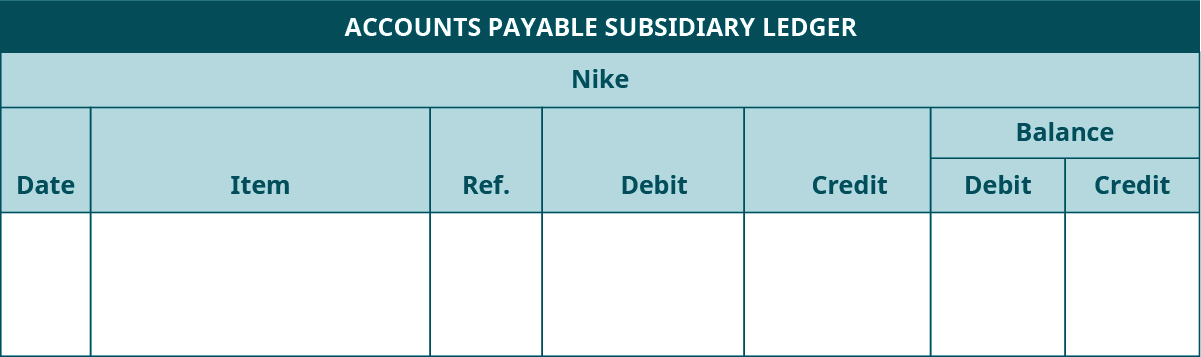

What are Bookkeeping Duties? – The Jobs, Skills, Salary & Career Paths of Bookkeepers

Even so, the BLS still projects more than 170,000 annual openings for bookkeeping, accounting, and auditing clerks from 2020 to 2030. In small businesses, payroll bookkeeping is usually included in bookkeepers’ general duties. Larger companies or public organizations may hire payroll bookkeepers as a separate role. They record https://goodmenproject.com/business-ethics-2/navigating-law-firm-bookkeeping-exploring-industry-specific-insights/ financial transactions, update statements, and check financial records for accuracy. Bookkeepers also record inbound payments – the money an organization receives from clients and other businesses. For a company that deals in a few expensive transactions a day, like a car dealership, entries may be made for each transaction.

But, the books need to get done, and they need to be done each month if you want to have a successful business. Our partners cannot pay us to guarantee favorable reviews of their products or services. When you have dedication and diligence, no task is difficult, especially accounting.

Do Bookkeepers Need a Degree?

These transactions typically include sales revenue, business expenses and purchases, invoices, accounts payable, and accounts receivable. Bookkeepers don’t need a special certification, but a good bookkeeper is important for an accountant to have accurate financial records. One of your responsibilities as a bookkeeper is presenting the financial records you’re handling to accountants and your clients. By knowing how to communicate properly (whether online or in-person), you’ll be able to present this vital information.

- Accounting is more subjective, giving you insights into your business’s financial health based on bookkeeping information.

- These bookkeepers specialize in making sure all of the organization’s bills are paid on time.

- When I created the fixed rates for these clients, I wanted it to add up to roughly $50 an hour.

- Bookkeepers don’t necessarily need higher education in order to work in their field while accountants can be more specialized in their training.

They also usually have access to different software tools and programs that can store and track economic data in a safe way. But many places will hire someone with a degree if they can show they are good at bookkeeping skills like accounts payable, accounts receivable, payroll, preparing financial statements, etc. Even if you don’t have a degree, the American Institute of Professional Bookkeepers (AIPB) will let you become a Certified Bookkeeper (CB). Single-entry bookkeeping is a simple way to keep track of your money. You only need to make one entry in your books for each transaction. Typically, these transactions are recorded in a cash book so that one can keep track of both incoming revenue and outgoing expenses.

]]>Content

- Stay up to date on the latest accounting tips and training

- Track Everything

- Accountant

- Understanding Independent Contractors

- Accounts Payable Specialist – Remote

- Buying or selling a business with independent contractors

Here is everything you need to learn about self-employment taxes for the self-employed, including how independent contractors pay taxes, the tax rate, and tax-deductible benefits. Self-employed or not, you need to monitor what’s going in and out of your bank accounts. Our bookkeepers will develop an easy framework when setting up your books.

Financial reports can prepare your business for the future by looking at your past and present to prepare you for future decisions. Documents submitted to the Payment Processing UT Box folder are imaged to the Image Retrieval System within 24 business hours, ususally sooner. Departments should not request rush processing if having the document imaged within https://www.bookstime.com/articles/accountant-for-independent-contractors 24 hours is sufficient. In this section, we’ll explore how freelance health insurance works, including health insurance coverage, the Affordable Care Act, and Marketplace. An expense for “Materials & Supplies” would typically include any tangible items used to produce your products, such as pens and pencils for a tutor or paintbrushes for an artist.

Stay up to date on the latest accounting tips and training

If an employer-employee relationship exists (regardless of what the relationship is called), then you are not an independent contractor and your earnings are generally not subject to self-employment tax. However, your earnings as an employee may be subject to FICA (social security tax and Medicare) and income tax withholding. Our accounting services are designed and centered around your type of business. Whether you’re a business owner with multiple team members or are a sole proprietor, we specialize in servicing independent contractors with all of your accounting needs. If a business realizes they have misclassified their employees they can report themselves under the Voluntary Classification Settlement Program (VCSP). Employers file Form 8952, Application for Voluntary Classification Settlement Program (VCSP).

An independent contractor is someone who is self-employed and is contracted to provide services to or perform work for another entity as someone who is not hired as an employee. Read more about misclassification and the difference between hiring employees and independent contractors. Typically an independent contractor will first send you an invoice, which will specify certain payment terms. Depending on your accounts payable process, you might also send them a purchase order back to confirm the invoice before issuing the final payment.

Track Everything

Their work is typically unrelated to the hiring businesses core activities. Employees are not self-employed and have an important, ongoing role in the operations of the business. If you’re self-employed, you’re not required to hire a bookkeeper or an accountant. However, hiring a professional is highly recommended when it comes to filing your taxes and making your tax payments. Submitting late or incorrect amount of tax payments can result in penalties and fines. An independent contractor is an individual who may run their own business but also performs work for other businesses.

]]>Content

- Educational material on applying IFRSs to climate-related matters

- Beginning Year Accumulated Depreciation

- Claiming the Special Depreciation Allowance

- Sum-of-the-years’-digits depreciation method

- Table of Contents

Enter that amount on line 10 of your Form 4562 for the next year. On February 1, 2022, the XYZ Corporation purchased and placed in service qualifying section 179 property that cost $1,080,000. It elects to expense the https://kelleysbookkeeping.com/ entire $1,080,000 cost under section 179. In June, the corporation gave a charitable contribution of $10,000. A corporation’s limit on charitable contributions is figured after subtracting any section 179 deduction.

For purposes of the half-year convention, it has a short tax year of 10 months, ending on December 31, 2022. During the short tax year, Tara placed property in service for which it uses the half-year convention. Tara treats this property as placed How To Calculate Beginning Year Accumulated Depreciation in service on the first day of the sixth month of the short tax year, or August 1, 2022. You figured this by first subtracting the first year’s depreciation ($2,144) and the casualty loss ($3,000) from the unadjusted basis of $15,000.

Educational material on applying IFRSs to climate-related matters

We are committed to offering world-class customer support, including knowledgeable staff technicians and financial analysts who are available to answer questions about our products and how to apply them for maximum results. Reporting capabilities include everything you need to report depreciation, acquisitions, and disposal. Produces tax reports for forms 4562 (Depreciation), 4797 (Sale of Property) and Personal Property Tax reports.

- Depreciation for intangible assets is referred to as amortization.

- If you combine these expenses, you do not need to support the business purpose of each expense.

- This is the only property the corporation placed in service during the short tax year.

- Depreciation must be considered to obtain a reasonable value for an asset that has been used over time.

You multiply the depreciation for a full year by 4.5/12, or 0.375. The following example shows how to figure your MACRS depreciation deduction using the percentage tables and the MACRS Worksheet. If you elect not to apply the uniform capitalization rules to any plant produced in your farming business, you must use ADS.

Beginning Year Accumulated Depreciation

You use GDS, the SL method, and the mid-month convention to figure your depreciation. Figure your depreciation deduction for the year you place the property in service by dividing the depreciation for a full year by 2. If you dispose of the property before the end of the recovery period, figure your depreciation deduction for the year of the disposition the same way. If you hold the property for the entire recovery period, your depreciation deduction for the year that includes the final 6 months of the recovery period is the amount of your unrecovered basis in the property.

You multiply the adjusted basis of the property ($1,000) by the 40% DB rate. You apply the half-year convention by dividing the result ($400) by 2. Depreciation for the first year under the 200% DB method is $200.

Claiming the Special Depreciation Allowance

For more information, refer to Calculations and Averaging Conventions. If the activity or the property is not included in either table, check the end of Table B-2 to find Certain Property for Which Recovery Periods Assigned. This property generally has a recovery period of 7 years for GDS or 12 years for ADS. In chapter 4 for the class lives or the recovery periods for GDS and ADS for the following. If it is described in Table B-1, also check Table B-2 to find the activity in which the property is being used. If the activity is described in Table B-2, read the text (if any) under the title to determine if the property is specifically included in that asset class.

You use an item of listed property 50% of the time to manage your investments. You also use the item of listed property 40% of the time in your part-time consumer research business. Your item of listed property is listed property because it is not used at a regular business establishment. You do not use the item of listed property predominantly for qualified business use. Therefore, you cannot elect a section 179 deduction or claim a special depreciation allowance for the item of listed property. You must depreciate it using the straight line method over the ADS recovery period.

MACRS Depreciation

If the percentages elected by each of you do not total 100%, 50% will be allocated to each of you. You must continue to use the same depreciation method as the transferor and figure depreciation as if the transfer had not occurred. However, if MACRS would otherwise apply, you can use it to depreciate the part of the property’s basis that exceeds the carried-over basis. You can use accounting software to track depreciation using any depreciation method.

- The land improvements have a 13-year class life and a 7-year recovery period for GDS.

- Larry uses the inclusion amount worksheet to figure the amount that must be included in income for 2021.

- Using the straight-line method, you depreciation property at an equal amount over each year in the life of the asset.

- You also made an election under section 168(k)(7) not to deduct the special depreciation allowance for 7-year property placed in service last year.

- Multiple methods of accounting for depreciation exist, but the straight-line method is the most commonly used.

Some assets are short-term, used up within a year (like office supplies). Long-term assets are used over several years, so the cost is spread out over those years. Short-term assets are put on your business balance sheet, but they aren’t depreciated. Unless you want to force a depreciation amount, you do not need to enter an amount in this field.

However, there is a simple way to calculate the depreciation for any asset. Assume that a company acquired a new vehicle for $10,000 four years ago. The vehicle was expected to have a useful life of 10 years and a salvage value of $5,000. The term salvage value refers to the estimated value of an asset at the end of its useful life.

The corporation first multiplies the basis ($1,000) by 40% (the declining balance rate) to get the depreciation for a full tax year of $400. The corporation then multiplies $400 by 5/12 to get the short tax year depreciation of $167. Instead of using the above rules, you can elect, for depreciation purposes, to treat the adjusted basis of the exchanged or involuntarily converted property as if disposed of at the time of the exchange or involuntary conversion.

Why Is Depreciation Estimated?

In addition to straight line depreciation, there are also other methods of calculating depreciation of an asset. Different methods of asset depreciation are used to more accurately reflect the depreciation and current value of an asset. A company may elect to use one depreciation method over another in order to gain tax or cash flow advantages. Generally Accepted Accounting Policies (GAAP) require that depreciation expenses be charged to all fixed assets based on the estimated economic life of each. Once purchased, PP&E is a non-current asset expected to deliver positive benefits for more than one year. Rather than recognizing the entire cost of the asset upon purchase, the fixed asset is incrementally reduced through depreciation expense each period for the duration of the asset’s useful life.

Not only do service companies have no goods to sell, but purely service companies also do not have inventories. If COGS is not listed on a company’s income statement, no deduction can be applied for those costs. Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the good.

- Retailers need to track the cost of goods sold (COGS) to ensure they are profitable and reporting expenses to the IRS correctly.

- The total cost of finished goods that were not sold within the financial period is then subtracted from the sum to arrive at COGS.

- Typically, calculating COGS helps you determine how much you owe in taxes at the end of the reporting period—usually 12 months.

- A Magento POS (point of sale) system can be seamlessly integrated with your Magento website(s) to synchronize data between your online and offline stores, streamlining retail operations.

- The averaging method for calculating COGS is a method that doesn’t consider the specific cost of individual units.

Notice that this number does not include the indirect costs or expenses incurred to make the products that were not actually sold by year-end. The purpose of the COGS calculation is to measure the true cost of producing merchandise that customers purchased for the year. With a periodic system, cost of goods sold is not calculated until financial statements are prepared. The beginning inventory balance (the ending amount from the previous year) is combined with the total acquisition costs incurred this period. All missing inventory is assumed to reflect the cost of goods sold. When a periodic inventory system is in use, how are both the ending inventory and cost of goods sold for the year physically entered into the accounting records?

Exclusions from cost of goods sold

If your business sells products, then it’s important to know how to calculate what these products cost you. Properly calculating the cost of goods sold, also known as COGS, helps you price correctly and deduct your business expenses appropriately for tax purposes. The specific identification method is an accounting method that allows companies to assign specific values to individual units sold in a particular period. This method can be ideal for businesses that sell custom goods or services or those with inventory that varies widely in value – a shop for valuable antiques, for instance. In accounting, the cost of goods sold is critical for determining the profitability of a company, department or product line. It’s an important metric for companies tracking the direct costs of their business inventory.

What Is Cost of Goods Sold? Definition, Calculation & FAQ – TheStreet

What Is Cost of Goods Sold? Definition, Calculation & FAQ.

Posted: Mon, 19 Jun 2023 07:00:00 GMT [source]

When the boutique sells a shirt, COGS accounts for the sewing, the thread, the hanger, the tags, the packaging, and so on. It also includes any goods bought from suppliers and manufacturers. Your inventory at the beginning of the year, recorded on January 1, 2022, is $20,000.

Cost of goods sold in a service business

To use the inventory cost method, you will need to find the value of your inventory. The IRS allows several different methods (FIFO or LIFO, for example), depending Calculate cost of goods sold on the type of inventory. The IRS has detailed rules for which identification method you can use and when you can make changes to your inventory cost method.

The IRS requires businesses that produce, purchase, or sell merchandise for income to calculate the cost of their inventory. Depending on the business’s size, type of business license, and inventory valuation, the IRS may require a specific inventory costing method. However, once a business chooses a costing method, it should remain consistent with that method year over year. Consistency helps businesses stay compliant with generally accepted accounting principles (GAAP). This tax calculation of COGS includes both direct costs and parts of the indirect costs for certain production or resale activities as defined by the uniform capitalization rules. Indirect costs to be included for tax purposes include rent, interest, taxes, storage, purchasing, processing, repackaging, handling and administration.

Using LIFO, the jeweler would list COGS as $150, regardless of the price at the beginning of production. Using this method, the jeweler would report deflated net income costs and a lower ending balance in the inventory. Beyond that, tracking accurate costs of your inventory helps you calculate your true inventory value, or the total dollar value of inventory you have in stock. Understanding your inventory valuation helps you calculate your cost of goods sold and your business profitability. The special identification method tracks the cost of each specific product to identify COGS and the ending inventory of each period. This method is used when a business knows precisely which items were sold and the exact cost.

Calculating COGS using a Periodic Inventory System

Sales revenue minus cost of goods sold is a business’s gross profit. Cost of goods sold is considered an expense in accounting and it can be found on a financial report called an income statement. There are two ways to calculate COGS, according to Accounting Coach. COGS is not addressed in any detail in generally accepted accounting principles (GAAP), but COGS is defined as only the cost of inventory items sold during a given period.

If you’re able to do this, you can lower the cost of this inventory and keep the price to your customers the same, resulting in more profit for you and no difference in quality for customers. For example, if you’re manufacturing backpacks, think of everything that goes into making one. A higher cost of goods sold means a company pays less tax, but it also means a company makes less profit. First in, first out, also known as FIFO, is an assessment management method where assets produced or purchased first are sold first. This method is best for perishables and products with a short shelf life.

The winning recipe for restaurant accounting

Businesses that hold physical inventory—such as manufacturers, retailers and distributors—are required to calculate COGS when determining their taxable income. To use the periodic inventory system, purchases related to manufactured goods must be accumulated in a “purchases” account. Because COGS is an expense, you would then subtract this amount from revenue on the income statement.

It’s important to note that this inventory valuation method is not accepted by the IFRS. Weighted averaging uses the mean price of all goods in stock, regardless of purchase date. This smooths Cogs through the period and reduces the impact of price spikes.

For detailed worksheets, see IRS Publication 334; for most managers, however, it’s sufficient to understand that this expanded calculation of COGS typically decreases the total tax bill. Cost of goods sold is a company’s direct cost of inventory sold during a particular period. It includes all costs directly allocated to the goods or services sold in a given week, month or year. But, it excludes any indirect or fixed costs such as overhead and marketing; it’s just the cost to purchase or manufacture inventory sold in a given timeframe.

Companies that sell products need to know the cost of creating those products. The cost of goods will typically be shown in the company’s profit and loss account. In this case, the total cost of goods sold for the year would be $110,000. The store’s gross margin for the period (the gross sales for the year minus COGS) would be equal to $135,000 ($60,000 + $225,000 – $40,000 – $110,000).

Why is tracking cost important?

In the section below, we’ll highlight the ways you can address this issue in your company. Let’s continue with the backpack example for a school supply store. Say they had $10,000 worth of backpacks at the start of the month, but it’s the last month of summer vacation, and so the store stocks up on an additional $20,000 worth of backpacks. At the end of the month, they have just $2,000 worth of backpacks to be sold to their customers. Luckily for middlemen and redistributors, COGS is much more simple to determine. Here, you’ll just have to look into inventory, since your employees’ hourly labor is not tied to the production of these goods.

Cost of goods sold, or cost of sales, is the direct cost of manufacturing or acquiring the products that you sell during a period, such as quarterly or annually. These costs include core components that create your products like the materials and direct labor required in production. With the exception of Specific Identification, all of the abovementioned methods provide cost estimations for sold inventory.

Inventory includes the merchandise in stock, raw materials, work in progress, finished products, and supplies that are part of the items you sell. You may need to physically count everything in inventory or keep a running count during the year. If you are selling a physical product, inventory is what you sell.

On your balance sheet, this number should be the same as your ending inventory from the previous accounting period. Cost of goods sold is found on a business’s income statement, one of the top financial reports in accounting. An income statement reports income for a certain accounting period, such as a year, quarter or month.

For more information on how Sage uses and looks after your personal data and the data protection rights you have, please read our Privacy Policy. Costs that are excluded from Cogs include insurance and the costs of running your legal, sales, marketing, administration and HR departments. For partnerships, multiple-member LLCs, corporations, and S corporations, the cost of goods sold is calculated on Form 1125-A. This form is complicated, and it’s a good idea to get your tax professional to help you with it.

- Due to inflation, the cost to make rings increased before production ended.

- Both operating expenses and cost of goods sold (COGS) are expenditures that companies incur with running their business; however, the expenses are segregated on the income statement.

- Plus, your accountant will appreciate detailed records come tax time.

- It also includes any goods bought from suppliers and manufacturers.

Every business that sells products, and some that sell services, must record the cost of goods sold for tax purposes. The calculation of COGS is the same for all these businesses, even if the method for determining cost (FIFO, LIFO, or average costing method) is different. Businesses may have to file records of COGS differently, depending on their business license. Typically, COGS can be used to determine a business’s bottom line or gross profits. During tax time, a high COGS would show increased expenses for a business, resulting in lower income taxes.

The LIFO method will have the opposite effect as FIFO during times of inflation. Items made last cost more than the first items made, because inflation causes prices to increase over time. The LIFO method assumes higher cost items (items made last) sell first. Thus, the business’s cost of goods sold will be higher because the products cost more to make.

]]>

The Aplos Team is here to help you accomplish your goals with educational materials that can provide best practices, tips on how to use the software, and examples to inspire you. Create internal policies and controls to significantly improve your fraud protection. Implement a code of ethics, which will show those affiliated with your church the values of the organization.

Church accounting involves recording expenses, tracking congregation contributions, and monitoring spending on the different projects and activities. The focus is not on profitability, but on activities that support the congregation and members of the society. For this reason, their approach to accounting is through accountability. Financial professionals should have a good grasp of the generally accepted accounting principles and the requirements of the IRS.

- The church accounting software solution you choose must evolve around the fund accounting system.

- Understanding your church’s expenses will help you better allocate resources realistically in the future.

- Accounting software handles tithing, other forms of contributions, and fundraising events.

- Multiple ledgers let churches organize and classify financial transactions in a systematic way.

- The major problem with this is that checkbooks aren’t a double-entry system, thus reporting was a nightmare.

We also considered payroll and online payment integration, as long as it was not through a third-party app. Overall, we also gave a score for subjective ease of use based on the overall experience when navigating and using the software. QuickBooks does a lot of the work automatically, saving you and your volunteers precious time.

Church Finances Part II: The Importance of Financial Statements

By Maintaining designated donor funds the church ensures transparency, accountability and honesty. Beyond these important values, there’s also the FASB requirement that states, churches must keep designated monies separate from the undesignated monies. FASB (Financial Accounting Standard Board) is the organization that issues accounting standards that all government entities like the SEC, IRS and so on follow. This quote signifies the importance of understanding accounting principles but emphasizes that too often organizations forget to build in the margin of safety when it comes to their accounting. When improper accounting techniques are used or organizations budget with a break-even mentality, the financial health of the church is in jeopardy.

It’s important to have a basic understanding of how a church operates along with some basic accounting knowledge in order to set up and maintain an efficient accounting system for your church. The church accounting system is centered on advancing the mission and objectives of the church rather than generating profits. Financial resources are reinvested back into the organization to support its goals, such as outreach programs, community support, and spiritual growth. This focus contrasts with for-profit entities, where the primary objective is to maximize profitability and shareholder value. Each revenue stream revolves around voluntary contributions from their congregation and supporters. Sometimes, these sources have specific conditions, requiring the funds to be used for certain activities.

Marshall Jones Specializes in Accounting for Churches

We also took into account the difficulty nonaccountants would have using these features. Many faith-based organizations rely on volunteers to help with their accounting. Create unique user IDs for each volunteer and assign access levels for each. Simplify the financial side of church management, from donations, expenses, taxes, and beyond.

A desktop alternative to consider is QuickBooks Premier Plus Nonprofit—it’s more powerful than PowerChurch Plus in terms of accounting features. We recommend choosing QuickBooks Premier Plus Nonprofit if you prefer full accounting software and access to QuickBooks ProAdvisors with knowledge in church and nonprofit accounting. QuickBooks offers discounted products for nonprofits through TechSoup, a nonprofit tech marketplace. We recommend that churches and other houses of worship use QuickBooks Online Plus or QuickBooks Advanced so they can get all the tools, tracking, and reporting features we offer. Sync your church accounting software with apps that help you communicate with donors and manage contributions with ease. Our church accounting software lets you create and email reports to all necessary stakeholders automatically, so everyone stays in the loop.

Some churches have staff or volunteers who perform some of the bookkeeping and/or accounting work and contract Benkorp to perform the remaining tasks. The tracking reports you put together have met with an enthusiastic reception by the Wardens and Parish Council and have led to a significant reduction in my time required on those Accounting for churches issues. They are a very experienced, professional and responsive team that has set up some very good financial processes for us. Their recommendation to move to Xero has been beneficial for audits and our own internal tracking. Think of this as a shortlist to start thinking about how to avoid these mistakes and others.

Payroll – process payroll for your employees, regular STP lodgements & annual finalisations, Worker’s Compensation calculations, organising employee payments. The stakes are pretty high when trying to keep an organization on the straight and narrow. When an organization drifts from this path because of inconsistencies or worse, embezzling, organizations typically end up losing money. Often, they end up closing their doors when money from donations is used incorrectly.

- Simplify your accounting by creating a free Wave account and add on the features you need, such as unlimited bank account connections, payroll services, and real-time donation updates.

- She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns.

- Outsourcing can be cost-effective and provide specialized expertise but may limit access, accountability, and control.

- As a 501(C)(3), churches are also required to follow the generally accepted accounting principles (GAAP) for various documents and reports and comply with the requirements set in place by the IRS.

- ACCOUNTS by Software4NonProfits is one of the top accounting software solutions crafted exclusively for the accounting needs of nonprofits.

Create realistic fundraising plans by using past data to set your goals. If this next year involves using new tools or techniques, consider lowering your goal until you’ve tried and tested these new strategies. And remember there’s nothing wrong with adjusting your plan when things go wrong, or even when they go right.

Churches vs. Businesses

PowerChurch offers both software packages for Windows PC installation and online software that can be used on any computer. For example, nursery or church event check-in stations are $14.95 per month. You must also pay $25 per month for every two users added above the included two-user limit. Churches have to abide by tax codes just like other nonprofits and for-profit businesses.

For-profits are only accountable to the regulations that govern their business and are out to make as much money as they can to subsidize the owners’ income. Here, we will cover the definition of church accounting, how church accounting is different from other organization’s finances, best practices, and what to look for in a church accounting software solution. The statement of activities is a vital financial report for a non-profit organization that offers a comprehensive view of its financial performance. It differs from the income statement used by for-profit businesses, with a focus on financial accountability, transparency, and alignment with the organization’s mission and objectives.

The Benefits Of Online Giving For Churches

The profit and loss (P&L) statement for churches is called the Statement of Activities, and the balance sheet for churches is called the Statement of Financial Position. Churches and nonprofit entities also have a special financial statement called the Statement of Functional Expenses. QuickBooks Premier Plus made it to this list as a great alternative to PowerChurch Plus in desktop accounting. Church and nonprofit accounting are similar, and getting the Nonprofit edition of QuickBooks Premier Plus is a good solution.

Key financial statements for churches

It also offers automated payment reminders, credit card, bank and Apple Pay payments or donations acceptance and a mobile app for depositing checks and finance tracking. IconCMO provides robust financial management capabilities, including accounting, budgeting, financial reporting, and revenue recognition. Users appreciate the software’s ability to track income, expenses, and donations and generate financial statements. ACS Technologies provides a general ledger, accounts payable, accounts receivable, and cash management capabilities, which enable churches to manage their financial information and produce financial statements. It also allows churches to easily track donations and pledge payments, including automatic deposit of electronic funds, and generation of donation statements for tax purposes.

Our expert analysis score is based on the overall experience of the software, from its general accounting features to specific church management features. IconCMO provides a family-based pricing system unlike other providers listed in this guide. Churches with few families don’t need to pay a fixed monthly fee regardless of congregation size. Aside from scalability, IconCMO offers more extensive church management features, such as Child Check-in and Allergy Tracking. Set up automatic reports to be created and sent on any schedule you need.

Estimate your income/expenses and foresee any potential financial shortfalls. Get a clear view of your church’s financial position with customized reporting. Obtain insights from financial data that support informed decision-making for growth. Connect multiple bank accounts, auto-sync transactions, and view them all in one place. Reconcile bank transactions with your accounting data with a few clicks. Our major focus for ease of use was customer support and assisted bookkeeping options.

]]>Content

- Cleaner Books Means Easier Planning

- Let Us Help You Find the Right Match for Your Business

- Need help finding a Bookkeeper?

- Accountants and bookkeepers in your area

- Financial Chain Corporation

- How much does a bookkeeper cost

Then provide them with all the documentation they require, including W-2s, 1099s and more. Always ask to review the paperwork before it is submitted, and never sign a blank tax return. Accountants may offer a package rate for weekly, monthly or annual services to reward ongoing customers. Nationally, full-time staff accountants earn between $40,000 and $80,000, depending on experience and other factors. Our business bookkeeping services include credit card reconciliations; in bookkeeping, credit card reconciliations are just as important as bank reconciliations. Most small business owners mismatch credit card transactions in their Quickbooks [etc.] software.

The professional bookkeepers at Remote Quality Bookkeeping are highly skilled in managing transactions, processing payroll, and creating invoices. Our accountants, on the other hand, are experts in analyzing, classifying, and summarizing Accounting For Startups: Everything You Need To Know In 2023 financial data. Our professional tax accountants take the stress out of taxes and provide accurate small business and individual income tax preparation along with timely business quarterly tax preparation services.

Cleaner Books Means Easier Planning

If you run a larger company with employees, a bookkeeper can prepare payroll accounts, prepare financial statements for audits, and provide financial advice. Even if you have financial staff hired, there are many accounting tasks that your regular staff may not have time to take care of, which you can hire a bookkeeper to perform. A bookkeeper keeps track of your accounts, records, transactions, and can make your financial records ready to send to an accountant for larger tasks.

There are many reasons for outsourcing your company’s bookkeeping tasks- your bookkeeping staff is already busy and in need of extra help, or you may not have time to handle your daily bookkeeping. With our help at Ageras, you can easily find a bookkeeper and avoid the hassle of searching the web and calling around to different bookkeepers for their rates. Every business, big or https://simple-accounting.org/becoming-a-certified-bookkeeper-step-by-step/ small, need to have bank reconciliations performed at the end of every month. Our bookkeepers make sure that checks, debt card transactions, ACH transactions, and bank fees are all reconciled and match what’s in your accounting software—like Quickbooks or Wave. Accountants’ rates vary based on their education, licenses, experience, and the work for which they are being hired.

Let Us Help You Find the Right Match for Your Business

With Premium, you get expert tax prep, filing, and year-round tax advisory support. Xero champions are firms whose team members have completed the most Xero training and who are growing fast. All firms listed in the directory have staff members trained in Xero and eight or more clients on Xero. Explore by location to find an accountant or bookkeeper, or use our match-making tool to find the perfect pair of hands. Find an accountant or bookkeeper who knows your niche, speaks your language, or is close by—whatever works best for you.

- Maybe you want to improve your current living situation or travel more.

- It is our responsible to ensure the safety of all whom we may come in contact with.

- When tax season rolls around, you want to be sure your Quickbooks, or spreadsheets are up to date, and have the right financial information.

- Discover how we can boost your cash flow, cut expenses, and increase your business’s profits.

- Most small business owners mismatch credit card transactions in their Quickbooks [etc.] software.

Maintain your accounts and have your invoicing handled by a professional. Paying your staff involves checking timesheets, allocating commission due, calculating payroll tax and superannuation, and so on. Maintaining accurate employee records, including their bank account details. Payroll must be processed through both the accounting system and the bank.

]]>

A well-established brand can make the firm more attractive to potential investors or buyers, which can lead to increased revenue and growth. Small firms can take advantage of innovative technology to provide high-quality services to their clients. By leveraging technology tools and software, small firms can improve their efficiency and effectiveness, which can help them compete with larger firms.

- When partners try to do everything themselves, they may not have the time or resources to pursue new business opportunities or to grow the firm.

- However, hiring software developers and engineers in foreign countries requires having a transfer pricing agreement in place.

- For an additional fee, Bench offers catch-up bookkeeping if you’re behind on your financials.

- We provide the expertise, resources, and infrastructure upon which founders and executive teams can grow strong, healthy companies.

- If your budget is a concern, you can consider low-cost options, such as 1-800Accountant or Bench Accounting.

For businesses with straightforward financials that are ready to outsource their bookkeeping, Bench Accounting is equipped to take it all on, making it our pick as the best accounting firm for bookkeeping services. For just $129 a month, clients receive a dedicated accountant and a detailed monthly reports. They also have the ability to create and send invoices Accounting firms for startups and prepare financial reports. A dedicated bookkeeper sets up your account and connects your bank and credit accounts for synchronized transaction reporting. The software used by 1-800Accountant integrates with many of the top accounting software packages. And with an already constrained time schedule, it’s easy for tight control over finances to slip away.

SaaS, Hardware, Biotech, eComm, Fintech and Crypto – the best accounting firm for startups

Autobooks is the first online banking-based, fully integrated payments and accounting application for businesses. Matera connects co-owners with lawyers, accountants, and web developers to help them manage their building. Second question is where would we find start up companies that specialize with Accountants only in mind? What it appears is happening is that these tech-startups are racing to create the most automated, but also, the most bare bones services available, at the absolute cheapest price possible. Get you in the door and onboarded quickly and standardize things to the absolute maximum in order to reduce price to the absolute minimum. We provide the expertise, resources, and infrastructure upon which founders and executive teams can grow strong, healthy companies.

- We offer personal service and actionable money saving advice to founders looking for a more hands-on CPA Firm.

- Look for a firm that is dedicated to providing excellent customer service and is available to answer your questions.

- Founded in 1999 by two former members of Price Waterhouse, 1-800Accountant is one of the more established online accounting firms.

- If the partners try to do everything themselves, they may not be able to focus on the most important aspects of the business.

In this article, we will discuss the importance of accounting services tailored for startups in Delhi. We will take a look at the benefits of having an experienced accountant manage your financial processes. We will also take a look at the services provided by Starter’s CFO, an accounting firm that specializes in helping startups in Delhi with their financial needs.

Nurturing Biotech Companies in New York

This can limit the firm’s potential and prevent it from achieving its goals. To avoid these problems, it is important for the partners in a new accounting firm to recognize the value of delegating tasks and responsibilities. Each partner should focus on their areas of expertise and trust their colleagues to handle other aspects of the business. This approach can lead to a more efficient, productive, and successful accounting firm that provides high-quality service to its clients. When it comes to managing the finances of a startup, it is important to choose the right accounting firm to get the job done.

Valtech Valuation launches a Valuation Dashboard for Startup Projects – Yahoo Finance

Valtech Valuation launches a Valuation Dashboard for Startup Projects.

Posted: Sun, 06 Aug 2023 07:00:00 GMT [source]

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. To improve your odds of success, you should have personal savings to cover one year’s worth of living expenses and assume the business generates very little in the first year to your family living obligations. Outsourcing simply to any firm cannot give desired results, so there are few aspects to consider while outsourcing. Taxfix is an app that uses a chat-like interface to simplify complex tax filing processes by only asking the user relevant questions.

Understanding your startup’s finances will boost your pitches

In all cases, it’s important to crunch the numbers to see what rate or form of billing makes sense for your business. If you already are using an accounting or bookkeeping software program, it would be ideal to work with a firm that utilizes the same software. If you don’t already use a software program, the accounting firm will recommend a package. Freelancers, who must be approved by Paro, establish their own fees, but Paro does not list a range of typical rates you should expect to pay.

Another strategy that accounting firms can use to avoid niching themselves into a corner is to remain flexible in their approach to client service. This may involve customizing services to meet the specific needs of each client rather than sticking to a rigid service offering. Additionally, offering a range of services that appeal to a broad range of clients can help to attract and retain clients. By focusing on client needs and remaining adaptable to changing market conditions, accounting firms can position themselves for long-term success. These top 5 accounting firms in Delhi are well equipped to handle the financial needs of startups and provide them with the advice and support they need to ensure their finances are managed in the most efficient way. Each of these firms has a team of experienced advisors and staff that are available to provide comprehensive financial services to startups.

Starter’s CFO provides comprehensive financial services that cover everything from tax filing, bookkeeping, and payroll to financial planning. They also provide access to expert advice and consulting on a range of financial topics. When starting a new business in Delhi, it is essential to consider the financial services needed to ensure the success of the venture. From accounting and tax services to payroll and bookkeeping services, financial services play a crucial role in the success of any business. It is important to work with an experienced accounting firm to ensure that the finances are managed and monitored effectively. This is why we are consistently recommended as the best accounting firm for Startups.

Get connected with the right company for you

Plus, if you’ve been neglecting your books, inDinero offers catch-up bookkeeping. Accrual accounting gives a clearer depiction of how your business is performing over a period of time, while cash accounting is more narrowly focused on the cash flowing in and out of your business. Just because you received a big check from a customer or paid a large invoice at a given point in time doesn’t necessarily mean that those transactions are attributable to just that point in time. CPAs are highly qualified accountants, but if they don’t have experience with the precise requirements of your business, they could overlook important regulations or leave money on the table.

Every hour you spend on bookkeeping or accounting is one less hour spent marketing your business, building client relationships, and other business development activities. At some point, the cost to your business in terms of lost growth opportunities becomes immeasurable. Bench Accounting was launched in 2012 for the sole purpose of serving the bookkeeping needs of small businesses for both cash basis and accrual basis reporting. It’s now the largest bookkeeping service, with in-house professionals doing the bookkeeping for more than 11,000 business owners, which is why we chose it as the best accounting firm for bookkeeping services.

Familiarity With Your Finance Stack

Small firms can form partnerships and alliances with other firms or service providers to offer a broader range of services. By working together, small firms can compete with larger firms by offering a more comprehensive suite of services to their clients. As a startup in Delhi, it’s important to find the right accounting firm to handle your financial needs. Doing thorough research and properly evaluating the accounting firms can make a huge difference in your success. When selecting an accounting firm, it’s important to consider the firm’s capacity.

Do not get me wrong and let me be exceptionally clear; I believe these are very important and all firms today should be moving in that direction. My belief is that you will not be competitive in the years to come without these characteristics. But not all of you are going to raise millions of dollars to devote towards sales, marketing and technology. Winning the battle with these tech giants won’t be possible if you try to face them head on. Overall, the best accounting firms in Delhi for startups provide a multitude of benefits. Startups can trust that their finances are in capable hands and that they have the resources to effectively manage their finances.

Big Firm Competition –

Look for a firm that is dedicated to providing excellent customer service and is available to answer your questions. Evaluate the level of customer service provided by the firm and look for a firm that is willing to go the extra mile to provide you with the best services possible. With the help of Starter’s CFO and other accounting firms, startups in Delhi can streamline their financial processes and ensure accuracy and efficiency.

Additionally, consider for the accounting firm’s capacity and evaluate the level of customer service. Ultimately, finding the right accounting firm for your business is an important step that should not be overlooked. Online accounting firms typically charge a monthly fee, which can help businesses to plan their expenses. You can pay as low as $150 a month for a starter package that includes day-to-day bookkeeping, account reconciliation, and financial report preparation.

Founder’s CPA has deep industry expertise on three industries in the startup space. This unique focus allows our team

to provide our clients with unparalleled support as their business scales. Successful service businesses transition cash collection into a process that ensures they get paid promptly. In fact, cash collection needs to be a core competency to avoid cash flow crunches. To avoid cash flow crunches, we suggest BizPayO, a payment-processing portal. It makes getting paid a lot quicker and reduces the possibility of write-offs.

Content

- How to calculate and account for bad debt expense

- Global E-Invoicing and Payment Software

- Significance of Bad Debt Expense

- Generally Accepted Accounting Principles

- How To Estimate Bad Debt Expense When Using the Allowance Method (examples included)

- Ageing of accounts receivable formula example

- What Are Examples of Bad Debt Expense?

Using the percentage of sales method, they estimated that 1% of their credit sales would be uncollectible. The reason why this contra account is important is that it exerts no effect on the income statement accounts. It means, under this method, bad debt expense does not necessarily serve as a direct loss that goes against revenues.

If bad debt protection does not fit a company’s needs, there are alternatives. The best alternative to bad debt protection is trade credit insurance, which provides coverage for customer nonpayment in a wide range of circumstances. The desired $6,000 ending credit balance in the Allowance for Doubtful Accounts serves as a “target” in making the adjustment. The result from your calculation in the percentage of receivables method is your company’s ending AFDA balance for the end of the period.

How to calculate and account for bad debt expense

Another company that was growing rapidly, Johnstone Supply, grew concerned about its exposure to potential bad debt expense as its customer base expanded. In the past, the company knew all of its customers either personally or by reputation. However, as it grew, the company recognized that it could not eliminate the risk of bad debt expense entirely. It had so many new customers coming on board that it had to evaluate their creditworthiness via third party data and information that did not always provide an accurate picture of a customer’s financial state. Johnstone Supply ultimately decided to purchase credit insurance to reduce its exposure to bad debt expense. Cash flow is the lifeblood of any business so anything that reduces cash flow could jeopardize business success or even its survival.

The allowance for doubtful accounts resides on the balance sheet as a contra asset. Meanwhile, any bad debts that are directly written off reduce the accounts receivable balance on the balance sheet. In general, the longer an account balance is overdue, the less likely the debt is to be paid. Therefore, many companies maintain https://simple-accounting.org/10-companies-that-hire-for-remote-bookkeeping-jobs/ an accounts receivable aging schedule, which categorizes each customer’s credit purchases by the length of time they have been outstanding. Each category’s overall balance is multiplied by an estimated percentage of uncollectibility for that category, and the total of all such calculations serves as the estimate of bad debts.

Global E-Invoicing and Payment Software

If you have $50,000 of credit sales in January, on January 30th you might record an adjusting entry to your Allowance for Bad Debts account for $3,335. If you don’t have a lot of bad debts, you’ll probably write them off on a case-by-case basis, once it becomes clear that a customer can’t or won’t pay. Now let’s imagine that sometime later, a client tells you they won’t be able to pay the $2,000 they owe you.

- To do this, increase your bad debts expense by debiting your Bad Debts Expense account.

- Bad Debt Expense increases (debit), and Allowance for Doubtful Accounts increases (credit) for $48,727.50 ($324,850 × 15%).

- Businesses are now writing off an average of £16,641 as unrecoverable yearly.

- At the end of an accounting period, the Allowance for Doubtful Accounts reduces the Accounts Receivable to produce Net Accounts Receivable.

- In order to do that, you have to be able to demonstrate you’ve taken reasonable steps to collect the debt.

One of the best ways to manage bad debt expense is to use this metric to monitor accounts receivable for current and potential bad debt overall and within each customer account. By setting certain thresholds for current and potential bad debt, a company can take action to manage and prevent bad debt expense before it gets out of hand. Bad debt expense also helps companies identify which customers default on payments more often than others. On March 31, 2017, Corporate Finance Institute reported net credit sales of $1,000,000.

Significance of Bad Debt Expense

The percentage of sales formula involves taking your current bad debt expenses and dividing it by your total net sales, from which you get a ratio that can be used to estimate future bad debt losses. Bad debt represents a genuine material threat to the liquidity of your business. The Intuit Bookkeeping Expert Careers Remote Bookkeeping Jobs Quickbooks Live allowance for bad debt reserve is a contra-asset that is recorded in the asset section of the balance sheet. The company must roll forward the reserve each year to make sure the reserve is adequate. To increase the reserve, the company would record additional bad debt expense.

The balance sheet aging of receivables method is more complicated than the other two methods, but it tends to produce more accurate results. When reporting bad debts expenses, a company can use the direct write-off method or the allowance method. The direct write-off method reports the bad debt on an organization’s income statement when the non-paying customer’s account is actually written off, sometimes months after the credit transaction took place. Company accountants then create an entry debiting bad debts expense and crediting accounts receivable.

]]>

One common question we receive is where their Adjusted Gross Income is on their W-2. Because AGI is something you need to calculate from several sources it’s not printed on your W-2. It helps determine your eligibility in other financial situations, like applying for a loan to buy property, eligibility to rent an apartment, or getting a student loan to pay for higher education. Read on as we outline more information about Adjusted Gross Income (AGI), how to calculate AGI, and how you, the taxpayer, might be able to reduce your AGI.

For individuals and corporations, the after-tax income deducts all taxes, which include federal, provincial, state, and withholding taxes. It can also include local taxes, such as sales and property tax. After deducting all applicable taxes, the after-tax income represents the total disposable income available to spend. When you start a new job or get a raise, you’ll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isn’t a simple matter of multiplying your hourly wage by the number of hours you’ll work each week, or dividing your annual salary by 52.

Definition of Adjusted Gross Income

Some common examples of deductions that reduce adjusted gross income include deductible traditional IRA contributions, health savings account contributions and educator expenses. Most individual tax filers use some version of the IRS Form 1040 to calculate their taxable income, income tax due, and after-tax income. To calculate after-tax income, the deductions are subtracted from gross income. The difference is the taxable income, on which income taxes are due. After-tax income is the difference between gross income and the income tax due.

This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. As an aside, unlike the federal government, states often tax municipal bond interest from securities issued outside a certain state, and many allow a full or partial exemption for pension income. Figures entered into “Your Annual Income (Salary)” should be the before-tax amount, and the result shown in “Final Paycheck” is the after-tax amount (including deductions). A financial advisor can help you understand how taxes fit into your overall financial goals. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

How to read a paycheck

However, this is assuming that a salary increase is deserved. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator. Employers may need to deduct garnishments from employee wages if they receive a court order to do so. This can occur if an employee defaults on a loan, has unpaid taxes or is required to pay child support or alimony.

Bieker: ‘Bracket creep’: Delaware’s hidden income tax – Bay to Bay News

Bieker: ‘Bracket creep’: Delaware’s hidden income tax.

Posted: Sun, 20 Aug 2023 09:00:00 GMT [source]

For more comprehensive and detailed calculations regarding budgeting, try our Budget Calculator; just note that it also utilizes a before-tax input for income. Aside from taxes, the net income after taxes also deducts operating expenses, interest, dividends, and depreciation. In the context of corporate finance, the net income after taxes is an important number because it represents the remaining profit for owners and shareholders. For publicly traded companies, a higher NIAT typically results in a higher share price. Traditionally, employees received printed checks in person or by mail, but more often today, the money is electronically deposited into a bank account.

Subtract “above the line” deductions

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used to help fill steps 3 and 4 of a W-4 form. The calculation is based on the 2023 tax brackets and the new W-4, which, in 2020, has had its first major change since 1987. While the calculation for after-tax income seems quite simple, there are many types of taxes that can be deducted. Normally, taxes deducted include federal, provincial, and state taxes.

After-tax income calculations can also deduct withholding taxes, which are taxes that are withheld from an individual’s wages and paid directly to the government. For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your company’s health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account (HSA) or Flexible Spending Account (FSA) to help with medical expenses, those contributions are deducted from your paychecks too. You can also fine-tune your tax withholding by requesting a certain dollar amount of additional withholding from each paycheck on your W-4.

Nursing care insurance

In the U.S., the concept of personal income or salary usually references the before-tax amount, called gross pay. For instance, it is the form of income required on mortgage applications, is used to determine tax brackets, and is used when comparing salaries. This is because it is the raw income figure before other factors are applied, such as federal income tax, allowances, or health insurance deductions, all of which vary from person to person. However, in the context of personal finance, the more practical figure is after-tax income (sometimes referred to as disposable income or net income) because it is the figure that is actually disbursed.

- Adjusted Gross Income is simply your total gross income minus specific deductions.

- After-tax income calculations can also deduct withholding taxes, which are taxes that are withheld from an individual’s wages and paid directly to the government.

- Given these options, it is possible for a taxpayer to evaluate their options and choose the filing status that results in the least taxation.

- To find an estimated amount on a tax return instead, please use our Income Tax Calculator.

- While individual income is only one source of revenue for the IRS out of a handful, such as income tax on corporations, payroll tax, and estate tax, it is the largest.

Net income after taxes (NIAT) is a financial term used to describe a company’s profit after all taxes have been paid. Net income after taxes is an accounting term and is most often found in a company’s quarterly and annual financial reports. Net income after taxes represents the profit or earnings after all expense have been deducted from revenue. Net income after taxes calculation can be shown as both a total dollar amount and a per-share calculation. The terms after-tax and pretax income often refer to retirement contributions or other benefits.

Family insurance

The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information. The money for these accounts comes out of your wages after income tax has already been applied. If you are early in your career or expect your income level to be higher in the future, this kind of account could save you on taxes in the long run. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes.

The digitised after-tax revenues for firms are relatively the same as for individuals, but companies begin by identifying total revenues instead of evaluating gross income. TaxAct E-File Concierge service provides phone calls and related support regarding federal e-file status changes using the phone number provided in My Account. Service is subject to availability and limited to federal e-filed tax returns.

service provides phone calls and related support regarding federal e-file status changes using the phone number provided in My Account. Service is subject to availability and limited to federal e-filed tax returns.

An increase in profits over multiple periods typically leads to an increase in the company’s stock price since investors would have a favorable view of the business. As a company generates additional net income, they have more cash to invest in the company’s future, which can include purchasing new equipment, technologies, or expanding their operations and sales. A company with positive net income growth is also in a better financial position to pay down debt or make an acquisition to boost their competitiveness and total revenue. The difference between the total revenues and the business expenses and deductions is the taxable income, on which taxes will be due. The difference between the business’s income and the income tax due is the after-tax income.

Get your pay up to 2 days early with Wisely® by ADP*

Student loan interest is interest paid during the year on a qualified student loan. The student loan interest deduction is another adjustment to your AGI. The maximum deduction you can claim is $2,500 this year – but it’s limited by your income. So, if your filing status is Single, Head of Household, or Qualified Widower, and your modified AGI is more than $90,000 in 2023, you don’t qualify. If you’re Married Filing Jointly and make more than $185,000 in 2023, you also can’t use this deduction to lower your AGI.

Former NBA Social Media Employee Goes Scorched Earth In Post … – Whiskey Riff

Former NBA Social Media Employee Goes Scorched Earth In Post ….

Posted: Mon, 21 Aug 2023 19:34:19 GMT [source]

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement After-Tax Income accounts such as a 401(k) or 403(b). So if you elect to save 10% of your income in your company’s 401(k) plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller.

The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

]]>